Managing your personal finances shouldn't feel like solving a mystery 🕵️♂️. Yet, keeping track of income, bills, and day-to-day expenses can often lead to unexpected overdrafts or missed payments 😱. That's where mytwoney comes in—a simple, intuitive web app designed to put you in control of your cash flow 💪.

Let's explore how mytwoney works and how you can use it to its full potential 🌟.

What Is mytwoney? 🤔

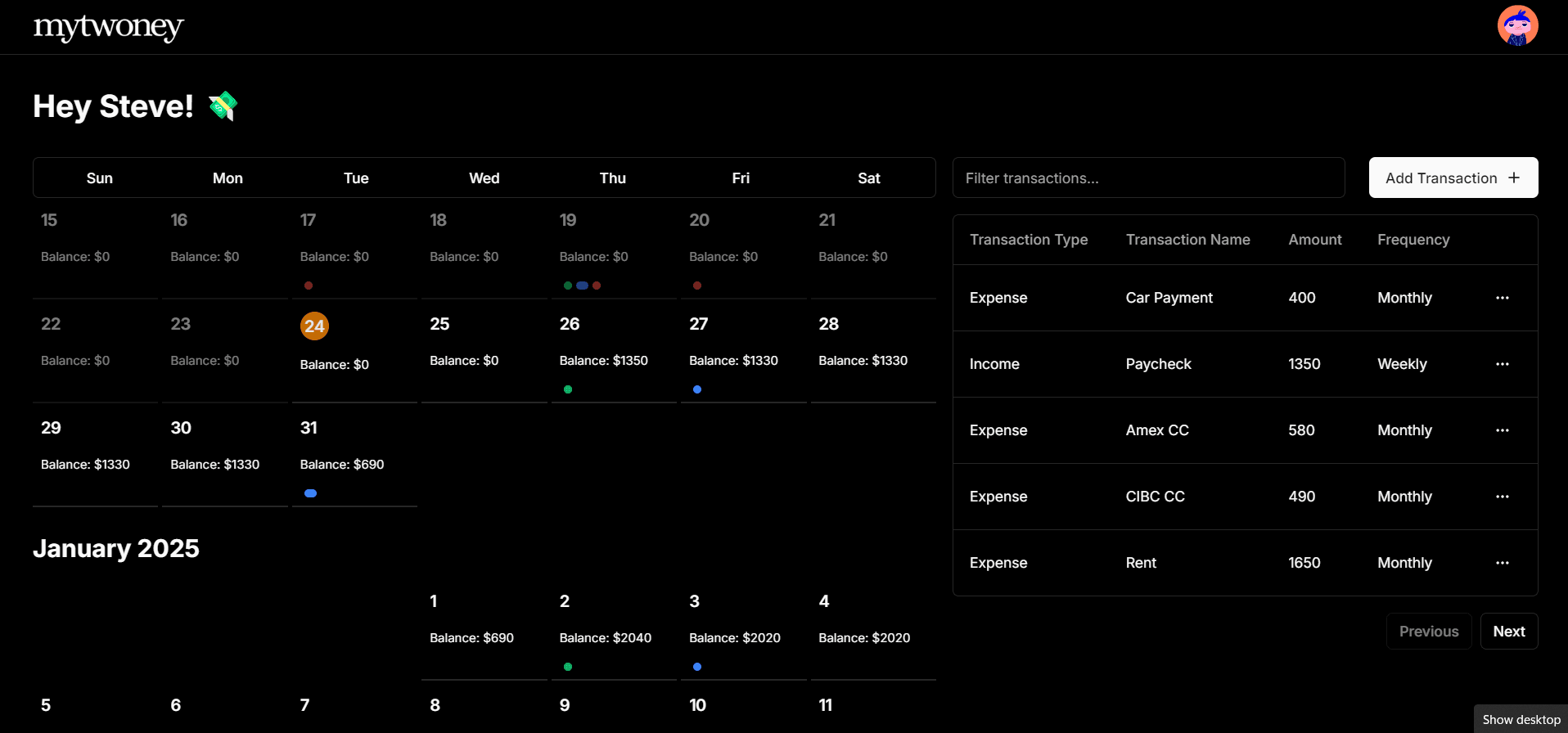

mytwoney is a free, responsive personal finance app that helps you visualize your cash flow on a calendar 📅. It's designed to answer one critical question: "When am I most likely to go broke?" 💸

With mytwoney, you can:

- Track your income and expenses 📊

- Set up recurring transactions like rent, bills, or paycheques 🔁

- Spot potential negative balances in advance with a calendar-based view 🔍

How mytwoney Works 🛠️

1. Set Up Your Transactions 📝

Imagine you're Alex, who receives a bi-weekly paycheque of $2,000. Alex also has a mix of recurring bills and variable expenses:

- $1,000 rent payment on the 1st of every month 🏠

- Weekly grocery costs of $200 🛒

- A streaming subscription that charges $15 on the 15th of every month 📺

By entering these transactions into mytwoney, Alex can see how these expenses line up with paydays and spot weeks where extra planning is needed.

2. Track Recurring Payments 🔄

Let's take Priya, whose regular expenses include:

- A bi-weekly car loan payment of $300 🚗

- Monthly utilities averaging $150, due on the 10th 💡

- A gym membership charged quarterly at $120 🏋️♀️

With mytwoney's recurring transaction feature, Priya only has to set these up once and specify the frequency. The app ensures they appear consistently on her calendar, so she always knows what's coming.

3. Visualize Your Cash Flow with Color Coding 🎨

One of mytwoney's standout features is its color-coded calendar view:

🟢 Green dots represent income days

🔵 Blue dots represent expenses that your balance can cover

🔴 Red dots highlight days where your balance won't cover your expenses

For example, if Alex notices a red dot on the 28th, he can click on that date to see a breakdown of transactions and identify the problem. The app helps Alex take proactive steps, such as moving funds from savings or adjusting non-essential spending.

If a day has multiple transactions, the dots grow into lines, making it easy to spot busy financial days at a glance.

4. Avoid Overdrafts 🚫

mytwoney's calendar view highlights potential negative balance days. Suppose Priya sees a red flag on the 29th due to overlapping bills and groceries. By spotting this early, she can:

- Transfer funds from savings 💳

- Delay non-essential expenses ⏳

- Avoid costly overdraft fees or bounced payments 💰

Why People Love mytwoney ❤️

It's Free to Use 🆓

Budgeting shouldn't cost a fortune. mytwoney is completely free for now, so you can enjoy all its benefits without worrying about subscriptions.

It's Tailored for Real Life 🎯

Whether you're managing bi-weekly paycheques, tracking household expenses, or saving for a vacation, mytwoney adapts to your unique needs.

It's Simple and Intuitive 🧠

No complex spreadsheets or confusing charts—just a clean, easy-to-read calendar that keeps your finances clear.

How to Get Started with mytwoney 🚀

- Sign Up: Create your account using Google for quick, secure access 🔐

- Set Up Your Transactions: Add income, expenses, and recurring payments 📊

- View Your Calendar: Keep track of cash flow and flag potential negative balance days 📅

- Plan Ahead: Adjust your spending to avoid surprises and stay on top of your finances 📈

Take Control Today 💪

Whether you're budgeting for bills, saving for a special goal, or just trying to avoid the dreaded "overdraft alert," mytwoney is here to help.

It's simple. It's intuitive. And best of all—it's free.

Your financial peace of mind is just a click away! 😌💖