Managing personal finances can be overwhelming, especially when unexpected expenses hit or cash flow doesn't align with your due dates. Overdraft fees and payday loans often become quick solutions—but at what cost? mytwoney is here to change the game, helping you stay ahead of financial pitfalls and take control of your cash flow. 💪

Let's dive into how mytwoney works and how you can use it to avoid overdraft fees and payday loans, plan smarter, and save money. 🏊♂️💡

The Problem with Overdraft Fees and Payday Loans 😱

Overdraft Fees:

Most banks charge between $30–$40 every time you overdraw your account. If you miss multiple payments, these fees can quickly pile up. For example:

- You're short $100 for a utility bill. 📉

- Your account overdrafts, triggering a $35 fee. 💸

- Two other payments are processed, costing you $70 more in fees. 😓

Payday Loans:

Payday loans seem like an easy fix, but their high-interest rates—often exceeding 300% APR—make them a dangerous cycle. Borrowing $500 might cost you $75 in fees for just two weeks, and if you can't pay it back, fees snowball. ❄️💰

How mytwoney Helps You Stay Ahead 🦸♂️

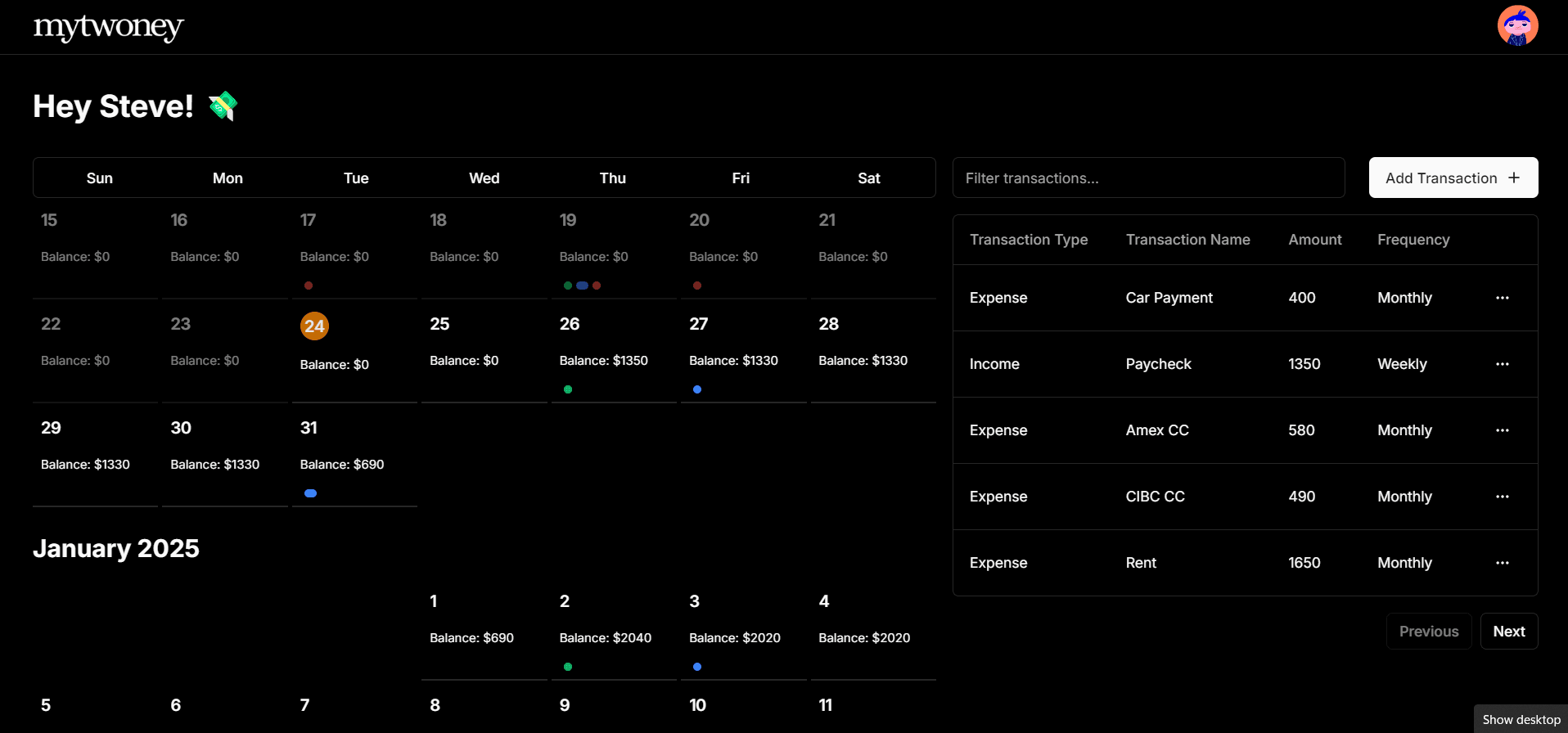

1. Visualize Your Cash Flow in a Calendar View 📅

When you input your income and expenses into mytwoney, our calendar does the heavy lifting. It categorizes each day with:

🟢 Green for income

🔵 Blue for expenses that your balance can cover

🔴 Red for expenses that might push you into the negative (potential overdraft days)

Example:

- Paycheque: $2,000 (🟢) on the 15th

- Rent: $1,200 (🔵) on the 1st

- Utilities: $300 (🔵) on the 7th

- Credit card payment: $500 (🔴) on the 12th (short $100)

With a quick glance, you know that you need to either save an extra $100 or reschedule your payment to after payday.

2. Plan Around Recurring Expenses ⏰

Set up recurring transactions like rent, utilities, and paycheques. mytwoney will automatically populate your calendar, so you're always prepared.

Example:

- Weekly groceries: $100 every Friday 🛒

- Bi-weekly paycheque: $1,500 every other Thursday 💼

- Monthly subscriptions: $50 on the 20th 📺

By seeing how these recurring payments affect your balance over time, you can adjust discretionary spending and avoid last-minute scrambles.

3. Avoid Overdrafts with Actionable Insights 🚦

mytwoney highlights potential overdraft days (red) so you can take action before it's too late:

- Reschedule payments: Call your utility provider to move your bill due date. 📞

- Transfer funds: Move savings into your main account to cover a shortfall. 💳

- Cut discretionary spending: Skip non-essential expenses like dining out. 🍽️

Example:

- Your calendar shows a red dot on the 25th, two days before payday.

- Clicking on the dot reveals that an $800 car repair bill will put you $200 in the negative. 🚗

- You transfer $200 from savings to prevent an overdraft and avoid the $35 fee. 🎉

4. Make Smarter Financial Decisions 🧠

mytwoney helps you make informed choices by showing you the bigger picture.

- Know exactly how much disposable income you have after covering essentials. 💡

- Identify patterns, like overspending on non-essentials during the first week after payday. 📊

Example: Your calendar shows multiple green dots at the start of the month and red dots closer to the end. You realize your discretionary spending ($300 on dining out) early in the month is leaving you short. Cutting that in half ensures all your bills are covered. 🍽️➗2️⃣

The Impact: Real Savings Over Time 💰

By avoiding just one overdraft fee each month, you save $35. That's $420 a year—enough for an emergency fund, a vacation, or paying down debt. Avoiding payday loans saves even more, protecting you from exorbitant interest rates that trap many in debt cycles. 🏖️

A Monthly Comparison:

| Scenario | Without mytwoney | With mytwoney |

|---|---|---|

| Overdraft Fees (3/month) | $105 | $0 |

| Payday Loan Fees ($500) | $75 | $0 |

| Total Monthly Cost | $180 | $0 |

That's $2,160 saved annually just by planning better! 🎊

Getting Started with mytwoney 🚀

- Sign Up: Use your Google account to log in securely. 🔐

- Add Your Transactions: Input your paycheques, bills, and recurring expenses. 📝

- Check Your Calendar: See when you're covered (🔵) and when you're at risk (🔴).

- Take Action: Adjust spending, transfer funds, or reschedule payments to stay on track. 🎯

Start Saving Today 🌟

mytwoney is free to use, making it an essential tool for anyone who wants to take control of their finances. Avoid overdraft fees, ditch payday loans, and enjoy peace of mind knowing you're financially prepared.

Ready to start your journey? Sign Up for mytwoney Now 🚀